Orders¶

Shortcut keys – B (Buy), S (Sell)

Order window¶

Hover over the instrument on the watchlist and click on Buy or Sell to initiate a buy or sell order window. Another way is to use the arrow keys and then type B or S.

Floating order window¶

To reposition the order window, just click on it and drag it wherever required.

Product types¶

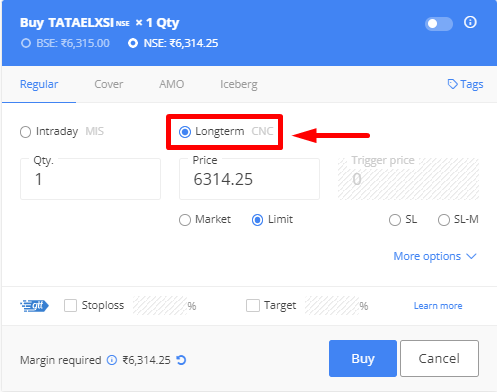

CNC (Cash n Carry)¶

For delivery based equity trades.

- 100% of funds are required to buy shares for delivery using the CNC product type, as no additional margin or leverage is provided.

- Shares must be available in the holdings to sell shares using the CNC product type.

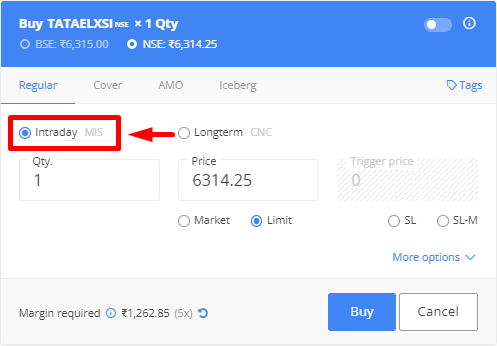

MIS (Margin intraday squareoff)¶

For intraday trades in equity and F&O segment

- Trade using MIS for additional leverage or margin.

- All MIS positions are auto-squared off 5 to 25 minutes before the market closes or when losses exceed 50% of the margin. The auto square-off rule can vary based on market conditions.

- Futures and Options (F&O): 5 minutes before the market closes.

- Currency segment (CDS, BCD): 15 minutes before the market closes.

- Commodity Segment (MCX): 25 minutes before the market closes.

- The minimum margin for equity intraday trades will be 20% of trade value (5X leverage).

- For F&O, 100% of NRML margin.

- Margins can be checked on the order window, margin calculator or bulletin. Visit zerodha.com/margin-calculator to calculate the margins required for a particular trade or zerodha.com/marketintel/bulletin/ to know the latest margins provided for various segments.

NRML (Normal F&O trades)¶

Use NRML to take positions without additional leverage. NRML positions can be held until expiry, provided the required margins are maintained. The order window displays the latest updated margin requirements. Visit zerodha.com/policies-and-procedures to learn more about margins.

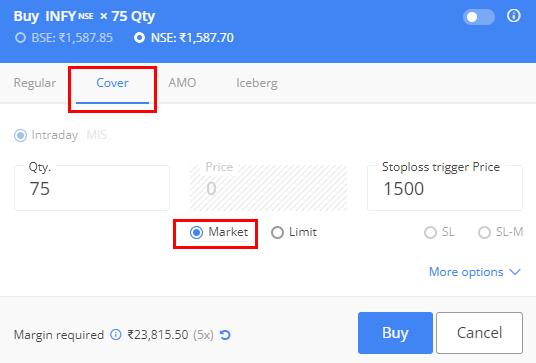

Cover Orders (CO)¶

A Cover Order (CO) is an order with an in-built risk mitigation mechanism. CO is a market order or limit order that is placed along with a stop-loss order and can only be used for intraday orders in the NSE EQ segment, i.e., equity segment of NSE.

Cover orders - Market¶

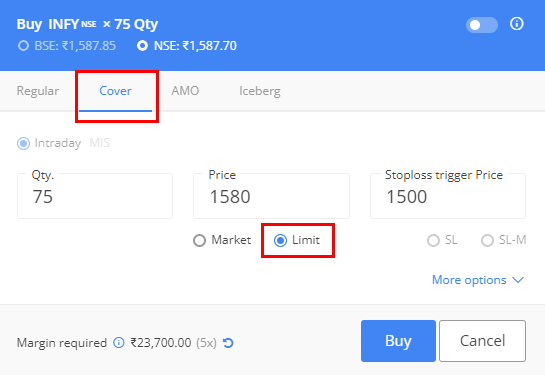

Cover orders - Limit¶

Enter a cover order position using a limit price by changing the CO order type to Limit. In the above example, Infy would be bought at ₹1580 (the current market price is ₹1587). This means the order would remain open until the stock reaches ₹1580 and then execute (just like a limit order) to initiate the position. The trigger price, which defines the SL, is set at ₹1500, so the stop loss would be placed as soon as the entry order is placed at Rs. ₹1580.

- The second leg of the Cover Order (CO) cannot be cancelled if the first leg is executed.

- The CO position cannot be closed from the positions tab. It can be only closed from the open orders by clicking on exit from the second leg of CO.

- CO cannot be converted to CNC/NRML.

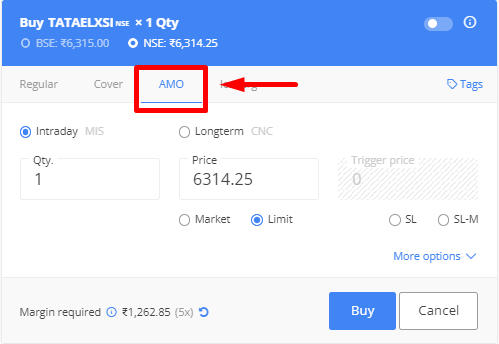

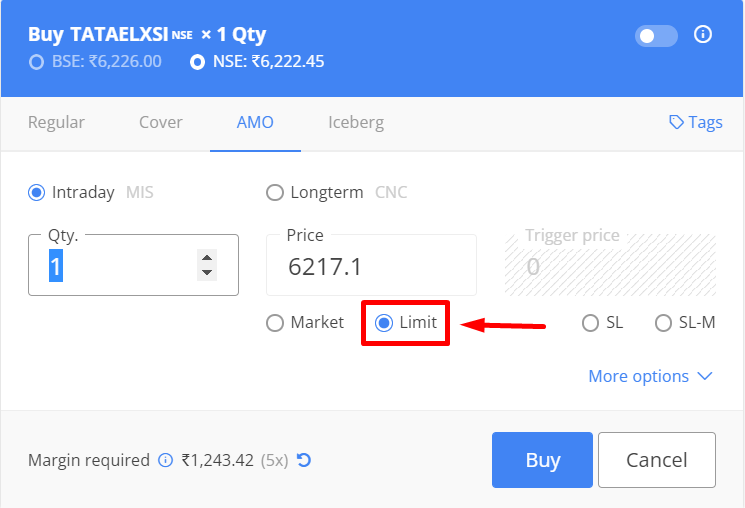

AMO (After market orders)¶

Place orders for the next trading day on the previous day itself. See What is an AMO and when can we place it?

AMO orders can only be placed at the following times:

| Segment | Timings |

|---|---|

| Equity | 3:45 PM to 8:57 AM for NSE and 3:45 PM to 8:59 AM for BSE. AMO sell orders can only be placed after 5:00 PM for non-POA IDs. To know if you have a POA or a non POA account, see How can I check if I have a POA or non-POA account with Zerodha? |

| Currency | 3:45 PM to 8:59 AM |

| F&O | 3:45 PM to 9:10 AM |

| MCX | Anytime during the day, if placed during the market hours, the order will go through the next day. |

Only CNC/NRML/MIS orders are allowed as AMOs.

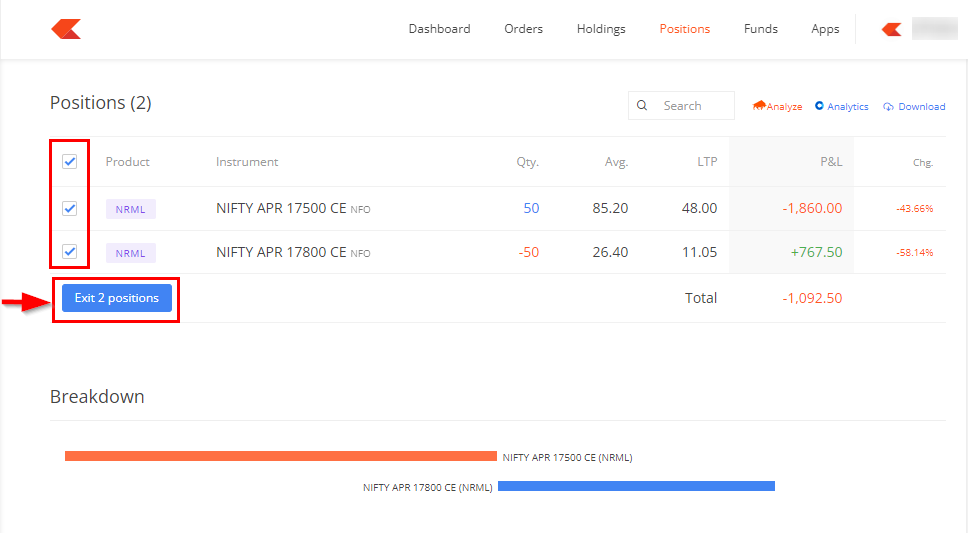

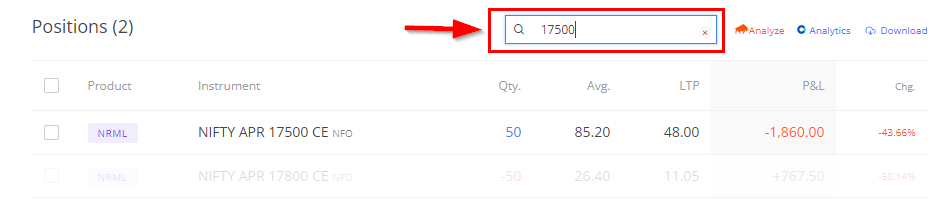

Exit multiple positions¶

To exit positions, follow these steps: 1. Click on Positions. 2. Select the positions. 3. Click on Exit positions.

Use the search to filter positions based on instrument, order type, product, etc.

Placing an order¶

Click on Buy or Sell or hit Enter on the keyboard to place an order. Order status notification will pop up on the screen, notifying the completion or rejection of the order.

Order types¶

Limit (LMT) order¶

A limit order is used to buy or sell instruments at a predetermined or specified price. If a Buy limit order is placed, the order will be executed at or below a predetermined price. Similarly, the order will get executed at or above a set price if a Sell limit order is placed.

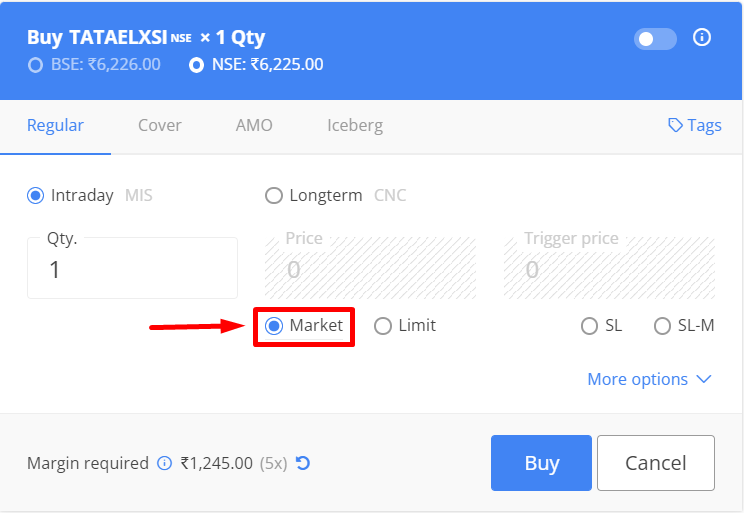

Market (MKT) order¶

A market order is used to buy or sell an instrument at the best available price. A Buy market order is placed to buy the instrument at any price the sellers are selling it at. Similarly, a Sell market order is placed to sell the stock at any price the buyers are willing to give.

Market orders on stock options have been disabled due to the illiquidity of stock option contracts. Only limit orders are allowed. Place a limit buy order higher than the current price or a sell order below the current price. This will act as a market order but will also protect against any impact costs due to illiquidity. To learn more, see What does “Market orders for stock options are blocked due to illiquidity” mean?

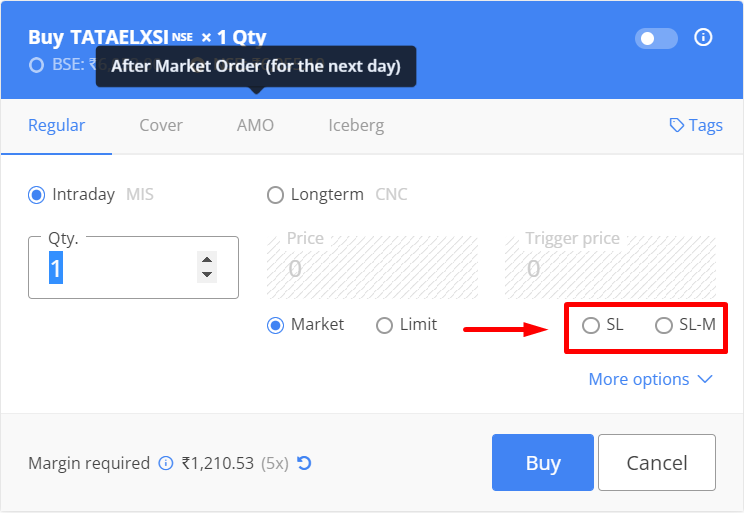

Stoploss or trigger orders (SL and SL-M)¶

A Stoploss order is a buy or sell order placed to limit losses when the price moves against the trade. In a Stoploss order, the trigger price is specified at which a limit or a market order is placed.

If a stock is bought at ₹100, a Sell stop loss order can be placed ₹95 to limit the loss. The stock will be sold as soon as it crosses or comes to ₹95. Such an order is called a Stoploss order, as it is placed to stop a loss that is greater than what one is willing to risk.

There are 2 types of Stoploss orders:

-

Stoploss Limit (SL) order = Price + Trigger Price

-

Stoploss Market (SL-M) order = Only Trigger Price

To learn more, see What are stop loss orders and how to use them?

SL-M orders are more likely to be executed than SL orders. Buy SL order is used to place orders above the current market price. Sell SL order is used to place orders below the current market price.

SL-M orders are blocked for index options to reduce the risk exposed towards the freak trades. To use a SL order like a SL-M order, see How to use Stoploss-limit(SL) order like a Stoploss-Market(SLM) order?

Iceberg orders¶

Iceberg is an order type that slices orders of larger quantity (or value) into smaller orders, where each small order, or leg, is sent to the exchange only after the previous order is filled. The minimum order value is ₹1,00,000 for equity and five lots for F&O. See What are Iceberg orders, and how to use them?

To place an Iceberg order, follow these steps:

1. Click on Iceberg on the order window.

2. Select Intraday or Overnight.

3. Enter Quantity and the Price.

4. Select Market or Limit.

5. Enter the Number of legs and click on Buy or Sell. The maximum number of legs per Iceberg is 10.

Sticky order window¶

When the order is placed on Kite, the order window automatically closes after the order placement. This behaviour of the order window can hinder an active trader who always trades with the same trading attributes, such as order type, quantity, price, etc.

The sticky order window feature helps to place multiple orders with the same input, as the order window remains open, and multiple orders can be placed with similar details from the same order window. See What is a sticky order window in Kite, and how can I use it?

To enable the sticky order window on the Kite web, follow these steps: 1. Click on the user ID. 2. Toggle the Sticky order window switch.

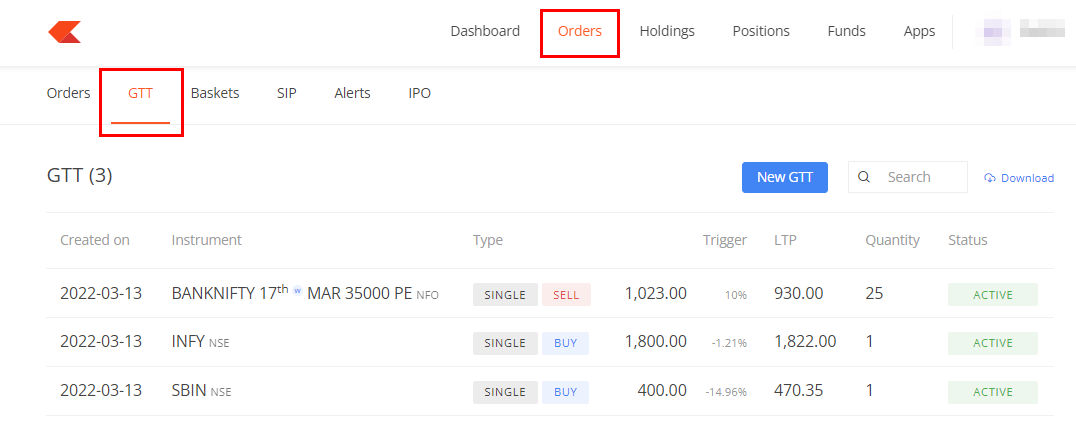

Good till triggered (GTT)¶

GTT is a feature that allows the client to set a trigger price, such that if the trigger price is hit at a future date, a limit order will be placed on the exchange as per the limit price and preset conditions. It is valid for 1 year or until the F&O contract’s expiry, so anytime the price condition within this period is met, the order will be placed and executed, provided there are enough funds in the trading account and the limit price order is filled on the exchange. This trigger set is valid only once. If the order is placed but not executed for any reason, the GTT has to be placed again. Zerodha sends push notifications in the app and emails once the GTT is triggered. Visit zerodha.com/tos/gtt to know more.

Single trigger - The single trigger can be used to enter into new positions or exit existing positions. The order is placed at the exchange when the trigger price matches or breaches the LTP.

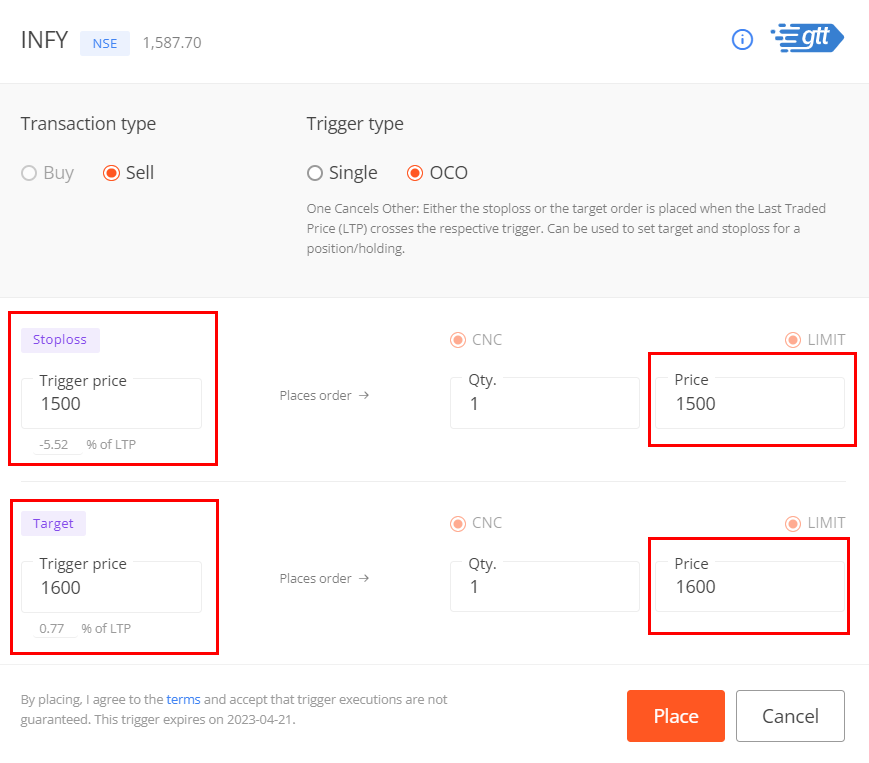

OCO (One Cancels the Other) trigger - Place an OCO trigger to set a stop-loss and target trigger. When either of the triggers is hit, the order is placed at the exchange, and the other trigger is cancelled. This can be used to set targets and stoploss.

Here are a few examples of how GTT can be used:

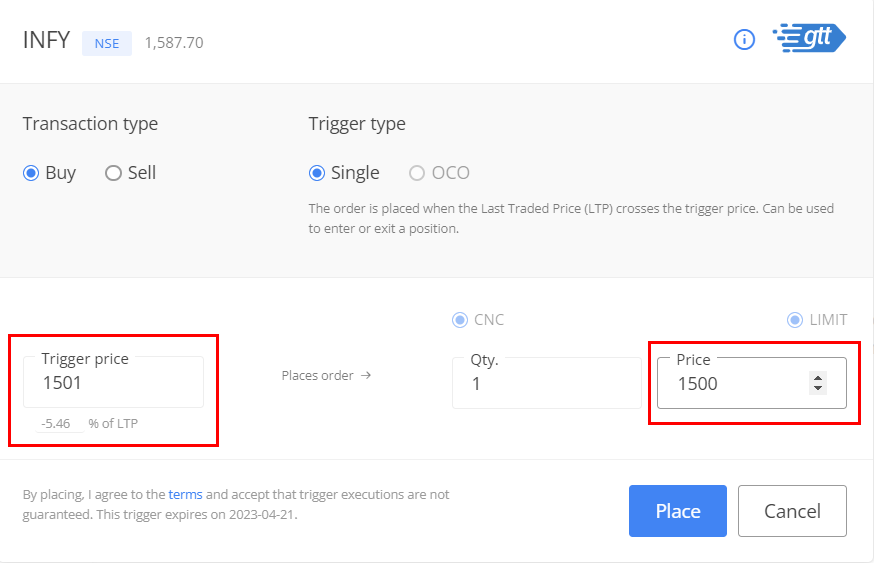

Buy GTT: Used for creating triggers to buy shares for delivery. With a GTT buy order, when the trigger price is hit, a buy order with the limit price mentioned is placed on the exchange.

- Example Scenario

The current price of Infy is ₹1587.70. A trigger of ₹1501 is placed, and if met on the exchange, a CNC limit order to buy Infy at ₹1500 will be placed on the exchange.

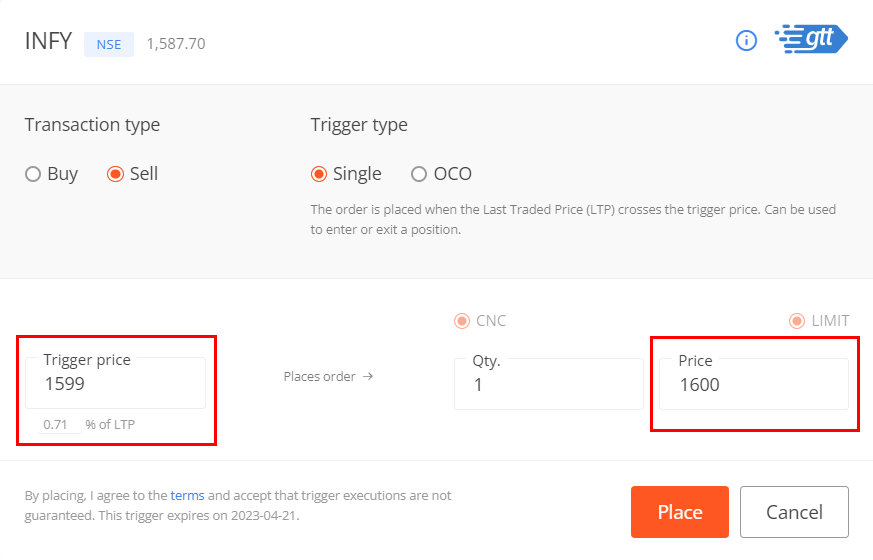

Sell GTT - Single: Used to exit current stock holdings, either with just a target order or both stop-loss and target orders where triggering one will cancel the other (OCO).

- Example Scenario

The current price of Infy is ₹1587. When the trigger of ₹1599 is met, a sell CNC limit order with a price of ₹1600 gets placed on the exchange. This sell order will be executed if the limit sell order is filled on the exchange and the shares are available in the demat account.

Sell GTT - OCO (One Cancels Other):

- Example Scenario

The current price of Infy is ₹1587.70. A target to sell Infy from the holdings at ₹1600 with a trigger price of ₹1600 and a stop-loss order to sell at ₹1500 with a trigger price of ₹1500 are placed. If either of the target or stop loss price conditions are met, a sell CNC limit order is placed while cancelling the other condition. This sell order will be executed if the limit sell order is filled on the exchange and the shares are available in the demat account.

- All non-POA clients will additionally have to authorise the transaction using CDSL TPIN. See What is the CDSL TPIN and how do I use it to sell my stock holdings?

- To know if the account with Zerodha is POA or non-POA, see How can I check if I have a POA or non-POA account with Zerodha?

Visit kite.zerodha.com/orders/gtt to find all active GTT orders. To know the reasons for cancellation of GTT, see Why are my GTTs Disabled/Cancelled/Expired/Rejected?

Order book¶

Shortcut key – O

Use the order book to track all open, completed, and rejected orders. Edit or cancel pending orders as shown below. Orderbook can be downloaded in CSV format.

Click on Options menu and then on Info to know the order details, including reasons for any rejected orders.

The orders can get rejected for one of many reasons, like insufficient margin, insufficient holdings, circuit limit, incorrect use of order type, scrip not available for trading, stock group change, etc. The rejection reason is displayed in the order book.

Use the search bar to filter orders quickly.

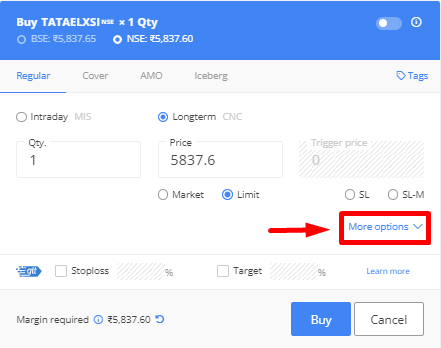

Advanced order types¶

Click on More options to select advanced order types.

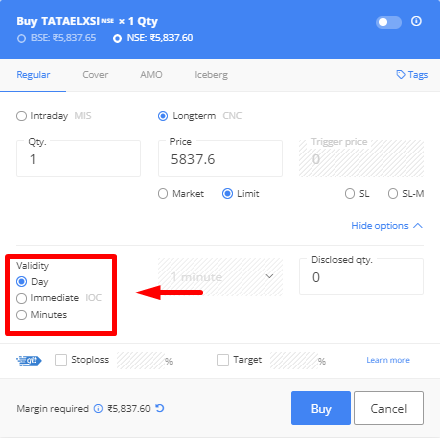

Regular orders with time validity¶

- Day orders are valid until the end of the day and are selected by default.

- Immediate or Cancel (IOC) ensures that orders are cancelled immediately if they are not completely filled.

- Minutes validity ensures that orders are cancelled if they are not filled within specified minutes. Validity can be selected from 1 to 120 minutes.

Basket orders¶

A basket order places multiple orders at the same time. They can be saved and used at any time.

- Click on Orders, Baskets and then on New basket.

- Name the basket and then click on Create.

- Search and add the instruments. A maximum of 20 orders can be added to the basket, and a maximum of 50 baskets can be created per user ID.

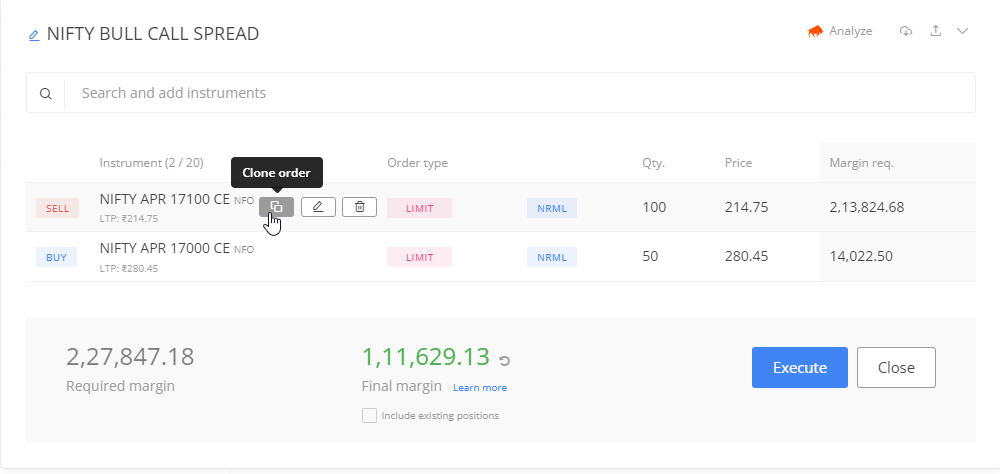

Hover over individual orders to delete, clone, edit, or drag and drop to change the sequence of the order.

The basket order can be shared by exporting the basket. To learn more, see How can I share Zerodha Kite baskets with my friends?

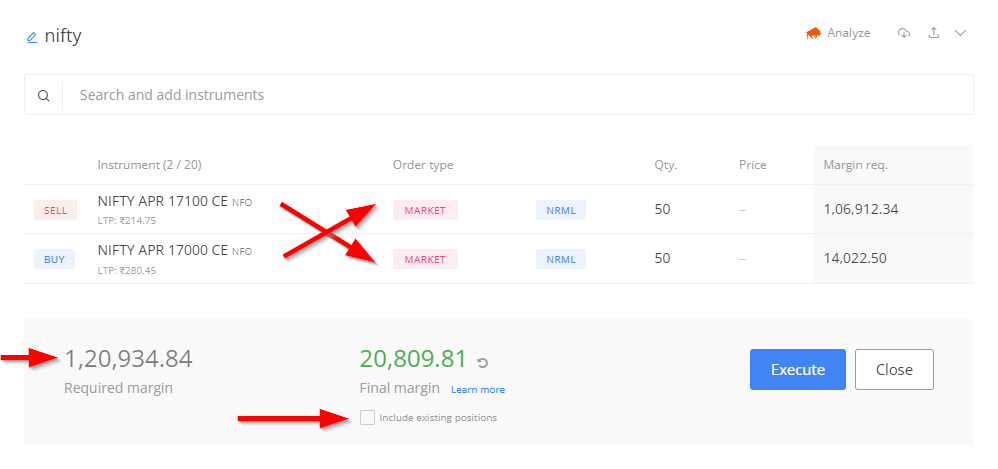

Margins for Basket order

Required margin is the funds needed to place all the orders in the basket.

Final margin is the eventual margin that will be blocked in the trading account after the order execution.

The required margin will differ depending on the order of the individual orders, but the final margin will be the same. For Nifty bull call spread example below, check how the required margin changes by rearranging the orders. As a result, when entering an F&O strategy, it is always better to place the buy option orders first so that the required margin is lower. This sequence of orders will make no difference when trading shares. Also, when shorting (writing) options, the final margin blocked for naked short option orders will be lesser as the premium will be credited to the account.

To check the margin requirements by including all open positions that are not part of the basket, select Include existing positions. But if this is selected, in some cases the required margin might show 0, whereas funds might be required to place the order. This is because an order in the basket could potentially reduce the overall margin, but the margin is still required to place the order. Keep this option disabled if it is confusing.

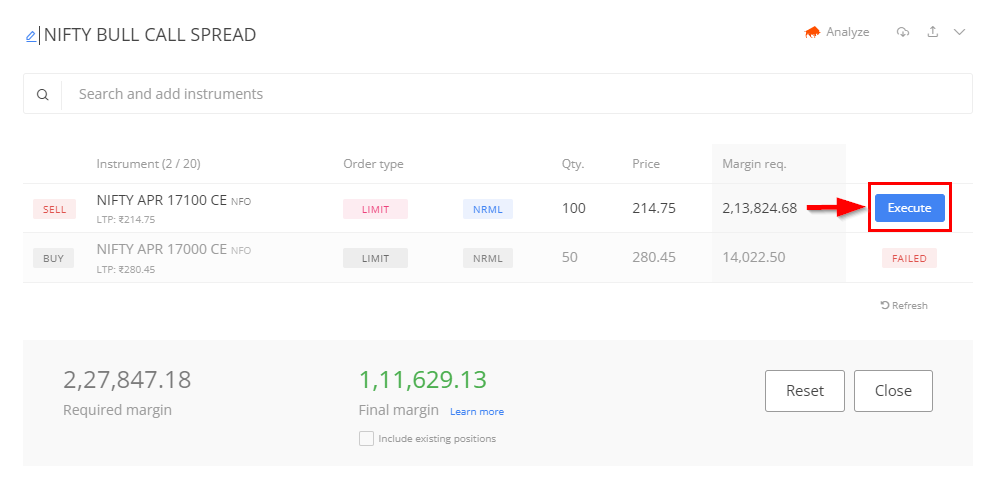

Execution

Click the Execute option on the basket to execute the order. The orders are placed in the same sequence as in the basket. Ensure to confirm the status of all the individual orders within the basket or on the Kite order book to see if the orders are placed, executed, or rejected after the basket order is executed.

Use the Clone option to get over the order freeze or quantity limit.

There are per-order maximum limits set when trading shares and F&O called Freeze quantity. Freeze quantity limits can be checked under Volume Freeze Quantity on the NSE website (WEB). To execute orders larger than this, place orders multiple times. With baskets, this can be done easily using the Clone order function.

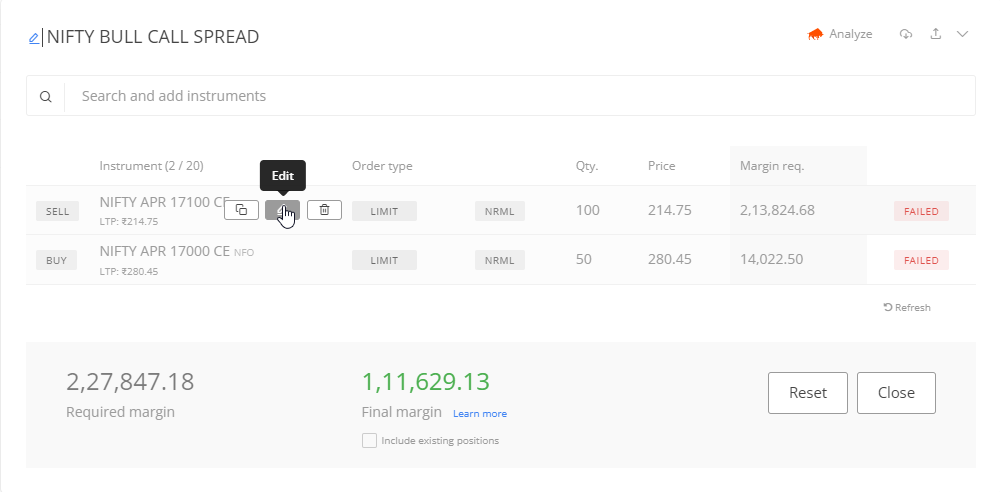

Replacing a rejected order

Assume a few of the orders that are part of the basket get rejected. The order can be edited and executed manually from the basket order window itself.

Minimise and easy access

To go back to the main screen while placing a basket order, minimise or just click outside the basket order.

SIP¶

The stock SIP feature can only be used for delivery trades in the cash market. To set up a stock SIP, follow the steps below:

- Click on Orders.

- Click on SIP.

- Click on Create new SIP.

- Enter a name.

- Select the basket.

- Set the preferred date and time.

- Click on Create.

- The existing basket of orders can be linked, or a new basket can be created. To know more basket orders, visit support.zerodha.com/category/trading-and-markets/kite-features/basket-order.

- A maximum of 50 SIPs can be scheduled on Kite.

- A user can link 3 baskets to 1 SIP and create 5 schedules for the month.

Stock SIP orders are purely a CNC product, and Market or Limit orders are allowed through SIP. Any other product or order type placed in the basket will not go through. See How can I setup a stock SIP on Zerodha Kite?

Kite alerts¶

Create real-time market alerts on any data point and combination on the cloud. With Kite alerts, simple alerts or alerts based on if, this, then, that conditions can be created. To know more about Kite alerts, see What are Kite alerts and how do I use them?

To create an alert:

- Click on the More context menu on an instrument.

- Select Create Alert.

- Enter a name.

- Select the Property as per requirement.

- Enter the value.

- Create.

- A maximum of 200 alerts can be created.

- A notification will be sent on Kite and on email.

Market timings¶

Equity¶

- Pre market - 9:00 AM to 9:15 AM

- Normal trading - 9:15 AM to 3:30 PM

- Post market - 3:40 PM to 4:00 PM

All new IPOs are listed on the exchange at 10:00 AM. The pre-open session for IPOs on listing day, when the buy and sell orders are collected to help reduce the volatility and improve price discovery, is from 9:00 AM to 10:00 AM

Visit zerodha.com/z-connect/queries/stock-and-fo-queries/pre-marketpost-marketafter-market-orders to learn more about pre and post-market sessions.

Currency¶

- 9:00 AM to 5:00 PM

Commodity¶

- Internationally referenceable non-agri commodities:

- March to November - 9:00 AM to 11:30 PM

-

November to March - 9:00 AM to 11:55 PM

-

Internationally referenceable non-agri commodities are as follows:

-

Base Metal - Aluminium, copper, lead, nickel, zinc and MCX Metldex

- Bullion - Gold, gold mini, gold guinea, gold petal, silver, silver mini, silver micro and MCX Bulldex

-

Energy - Crude oil, natural gas and MCX Enrgdex

-

Internationally referenceable agri commodities (Cotton, CPO and KAPAS) - 09:00 AM to 09:00 PM

- All Other agri commodities (Cardamom, menthaoil and rubber) - 09:00 AM to 05:00 PM

The markets are closed on trading holidays. Visit zerodha.com/z-connect/traders-zone/holidays/market-holiday-calendar-2023-nse-bse-and-mcx to see the market holiday calendar for 2023.

IPO¶

Apply online and invest in companies listing on the Indian exchanges with an Initial Public Offering (IPO) using UPI. To apply for IPOs, follow these steps:

- Click on IPO.

- Click on Apply.

- Select investor type.

- Enter the UPI ID.

- Enter the Qty and Price. The quantity should be a multiple of the lot size, and the price entered should be within the issue price range.

- Click on the undertaking checkbox and click on Submit.

- Accept the mandate on the UPI app.

- The exchange will send an SMS confirming the application by the end of the day. The bid details can be verified one day after applying for the IPO by visiting NSE (WEB) website.

IPO orders can be placed anytime between 10:00 AM on the issue opening day and 4:30 PM on the issue closing day. New applications that are placed during market hours are submitted to the exchange on the same day, whereas the applications that are placed between 4:30 PM and 10:00 AM the next day are submitted when the IPO market opens. The submitted IPO applications can be modified or cancelled only between 10:00 AM and 4:30 PM on trading days.

Visit support.zerodha.com/category/console/ipo for IPO-related queries.